Table of Contents

ToggleIngramSpark Royalty Calculator

IngramSpark Royalty Calculator

Introduction

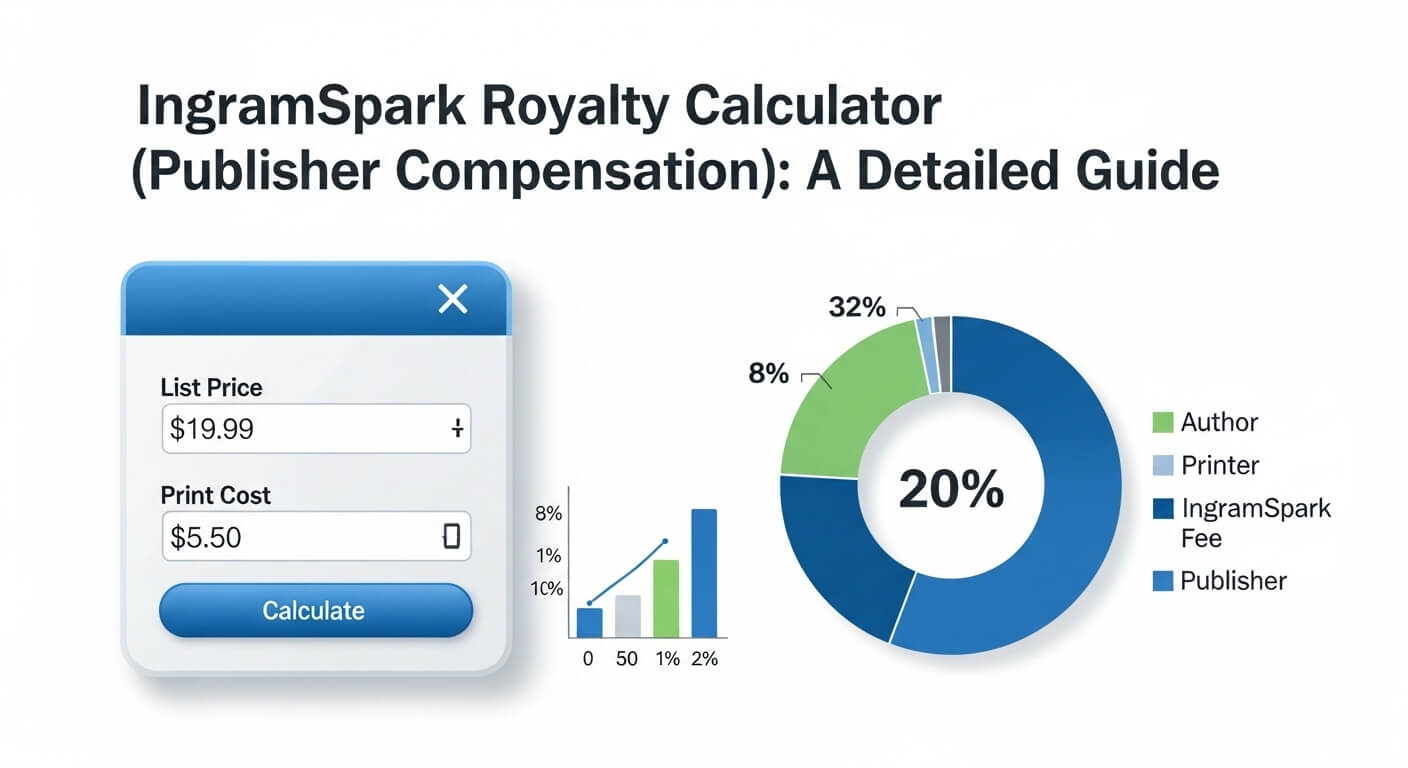

When you self-publish a book, one of your biggest questions is: “How much will I actually take home per copy?” Understanding your royalty, publisher compensation, and net earnings is crucial before setting your price. Factors like print cost, wholesale discount, and whether or not the book is returnable all influence your final earnings. That’s where the IngramSpark royalty calculator—also known as the publisher compensation calculator—comes in. This tool uses a specific formula that combines various inputs to show what you’ll earn on each sale. In this article, we’ll explain how it works, what inputs matter, how to handle returns, and why there are differences across markets. You’ll also learn strategies to maximize earnings, spot pitfalls to avoid, and explore real-world examples to help you make informed decisions and boost your profits.

What Is the IngramSpark Royalty / Compensation Calculator?

IngramSpark doesn’t always use the term “royalty”, instead they refer to publisher compensation for print sales. But essentially, the royalty calculator is a way to estimate how much money you (the author or publisher) receive after all deductions when a print book sells via IngramSpark’s distribution.

In practical terms, the calculator takes into account:

- The list price you set

- The wholesale discount (i.e. the discount you grant to retailers)

- The print cost (based on page count, trim size, color or black & white, paper type)

- Any fixed surcharges or fees (e.g. a print service surcharge)

- Returnability (i.e. how returns affect your net)

- Occasionally, market access or distribution fees

Using those, it outputs a per‑copy compensation (royalty) and breakdown. IngramSpark provides a “Compensation Calculator” in its dashboard.

In effect, the royalty calculator answers: “After bookstores, print costs, discounts, and returns, how much am I left with per sale?”

Key Variables in the Royalty Equation

To use or understand the royalty calculator well, you need to know the variables. Let’s break each down:

1. List Price (Retail Price / MSRP)

This is the price the consumer sees (before taxes). It’s the starting point for all calculations. You choose it in each IngramSpark market (US, UK, EU, etc.).

2. Wholesale Discount (Retail Discount to Booksellers)

Booksellers don’t pay list price — they expect a discount. That discount might range from 30% to 55%, though 50–55 % is typical in many markets. IngramSpark recommends a 55 % discount as a standard.

If you offer a 55 % discount, the bookseller pays you 45 % of list price (i.e. the net to the “wholesale side”). If you offer a lower discount (say 40 %), you capture more per sale, but many bookstores may not accept your book at that discount.

3. Print Cost (Production Cost)

This is how much it costs IngramSpark to print and bind one copy, given your book’s specifications:

- Page count

- Trim size (e.g. 5″×8″, 6″×9″, etc.)

- Color vs black & white interior

- Paper type (cream, white, thickness)

- Cover type (matte, gloss, laminated, hardcover vs paperback)

Books with many pages, color interiors, large trim sizes, or premium paper have higher print costs. Some estimates suggest a 200‑page black & white paperback might cost $3.50 to $5.00 to print.

In addition, IngramSpark sometimes applies a fixed “print service surcharge” (e.g. $3.50) for certain distribution modes (like e‑commerce share & sell).

4. Fixed Surcharges, Fees & Market Access Costs

- The print service surcharge is a fixed fee per copy in some cases (e.g. in their Share & Sell e‑commerce mode).

- In 2023, IngramSpark introduced a 1 % market access fee on list price in some markets — meaning 1 % of list price is deducted.

- In the past, IngramSpark also charged setup fees for new titles and revisions (e.g. $49 for print titles, $25 for ebooks), although free promotions and fee waivers sometimes apply.

5. Returns / Returnability

This is one of the trickiest variables. If you allow returns (i.e. bookstores can send back unsold copies), you bear the cost when books are returned. In many distribution models, booksellers demand a return clause. The effect of returns can drastically reduce your net compensation.

We will explore returns in depth below, because many authors underestimate how severely returns can affect net earnings.

The Basic Royalty / Compensation Formula (Ignoring Returns)

First, let’s look at the simplified version, ignoring returns, which gives your gross compensation per sale.

A widely used formulation is:

Royalty (per copy) = (List Price × (1 – Wholesale Discount)) – Print Cost – Surcharges & Fees

Alternatively:

Publisher Compensation = Net to Retailer – Print Cost – Fixed Fees

In notation:

- L = List Price

- D = Wholesale Discount (e.g. 0.55 for 55 %)

- P = Print Cost (including any surcharge or fee)

Then:

R = L × (1 – D) – P

In many sources, the formula is given similarly.

Example:

- Suppose you set L = $15

- You offer D = 55 % discount

- Suppose your print + surcharge cost P = $4.50

Then:

- Retailer pays: L × (1 – D) = 15 × 0.45 = $6.75

- Your royalty = $6.75 – $4.50 = $2.25

That’s the gross compensation.

In many cases, IngramSpark’s compensation calculator outputs a similar per‑copy compensation.

However — always remember: this does not yet include the impact of returns.

Returns: The Hidden Risk and Its Effect

Allowing returns means bookstores can send unsold copies back (usually within a fixed period).

When returns happen:

- You must refund the wholesale price to the bookseller

- You might also pay for return shipping or handling

- You lose your earlier “royalty” on that return (and then also lose print cost)

In effect, each returned copy can cost you the print cost (and possibly more).

How Returns Affect Net Compensation

Let’s define:

- RR = “royalty” for a returned copy

- R = your gross royalty per sold copy (from the formula above)

It can be shown (via algebra) that:

RR = – P (i.e. a returned copy costs you the print cost)

In other words, for any copy returned, you lose the print cost (plus other costs) as a negative.

Suppose you sold 100 copies, and 30 copies were returned (a 30% return rate). Then:

- 70 copies are truly sold → you get R per copy

- 30 copies are returned → you lose P per copy

So total net:

Total net royalties = 70 × R + 30 × (–P)

Divide by 100 (number of books) to get net royalty per copy sold (allowing for returns):

Net_Royalty_per_copy = (0.70 × R) – (0.30 × P)

Or, using the L, D, P notation:

Net_Royalty_per_copy = ( (1 – Return_Rate) × (L × (1 – D)) ) – P

Where “Return_Rate” is the fraction of sold copies that are returned.

As a more precise derivation, many authors use:

Net_Royalty = (1 – return_rate) × (L × (1 – D)) – P

This accounts for the fact that returns reduce the effective revenue base. (See Blue Paper’s discussion on return formula derivation.)

Illustrative Example:

- L = $13.99

- D = 55 %

- P = $5.96

- Return Rate = 30%

Compute:

- Retailer pays: 13.99 × (1 – 0.55) = 13.99 × 0.45 = $6.2955

- R (gross royalty) = 6.2955 – 5.96 ≈ $0.34 (this matches Ingram’s calculator for that input)

- Net per copy (allowing returns) = (0.70 × 6.2955) – 5.96 = 4.40685 – 5.96 = –$1.55315

In other words, with 30% returns, you’d lose $1.55 per copy on average! (This is a real risk many authors underestimate.)

Because of this, some authors decide not to allow returns at all (or limit return windows). But that can reduce bookstore willingness to stock your title. It’s a tradeoff.

E‑Book Royalties via IngramSpark

While the big complexity lies in print, it’s worth covering e‑book royalties too, for completeness:

- IngramSpark typically pays 85% of net revenue (i.e. after the retailer’s cut) for e‑book sales.

- However, many authors and commentators estimate that, overall, ebook royalty via IngramSpark ends up around ~40% of list price, depending on retailer contracts, fees, and distribution agreements.

- Some sources also mention that IngramSpark charges setup or revision fees for ebooks (e.g. $25) in certain circumstances.

Because ebook royalty structures are generally simpler (no print cost, no returns), many authors publish their ebooks via direct retailers (Amazon KDP, Apple Books, Kobo, etc.) and use IngramSpark mainly for print distribution.

Example Scenarios: How the Numbers Shift

Let’s walk through a few hypothetical scenarios to illustrate how different inputs change your compensation.

Scenario A: Conservative, industry-standard settings

- List Price, L = $20

- Wholesale Discount, D = 55%

- Print Cost + surcharge, P = $6.00

- Return Rate = 25%

Gross royalty (ignoring returns):

- Retailer pays: 20 × 0.45 = $9

- R = 9 – 6 = $3

Net (allowing returns):

- Net per copy = (0.75 × 9) – 6 = 6.75 – 6 = $0.75

So with a 25% return rate, your margin is thin.

Scenario B: More aggressive discount control

- L = $20

- D = 45% (booksellers get a 45% discount)

- P = $6.00

- Return Rate = 20%

Gross royalty:

- Retailer pays: 20 × 0.55 = $11

- R = 11 – 6 = $5

Net:

- Net per copy = (0.80 × 11) – 6 = 8.8 – 6 = $2.80

Better — but some retailers may reject lower discount terms or refuse returns in that case.

Scenario C: E‑commerce / direct sales via Share & Sell mode

IngramSpark’s Share & Sell e‑commerce mode allows you to bypass wholesale discount entirely; you get:

List Price – Printing Cost – Fixed Surcharge

For example:

- L = $16

- Print cost = $4.50

- Surcharge = $3.50

Royalty = 16 – 4.50 – 3.50 = $8.00

(Note: this assumes you are handling the customer sales directly; shipping and taxes are paid by buyer)

That’s significantly better than via wholesale. The downside is fewer retailers or bookstores accessing that route, and you must drive customer traffic.

Choosing the Right Settings & Strategy

Given how sensitive your net compensation is to these variables, here’s how to approach it:

1. Decide whether to allow returns (or in what window)

- Many traditional bookstores require returns to carry a title.

- If you disable returns, bookstores may refuse to carry your book.

- However, returns are costly and can wreck your profits. Some authors start without returns enabled, then later allow them selectively.

- Be careful: even after you disable returns, bookstores may still return copies for a period (some report up to 180 days) and you might be liable.

2. Choose a wholesale discount that balances appeal and margin

- 50–55 % is common and widely accepted by bookstores.

- Lower discounts (30–45 %) boost your margin but risk rejection by retailers.

- In many markets, IngramSpark enforces a minimum discount (e.g. 40 %)—you can’t go below it.

3. Optimize print cost

- Reduce page count if possible.

- Use black & white interior rather than color, unless your content demands it.

- Use standard trim sizes and standard paper types.

- Avoid premium materials where unnecessary.

Every dollar shaved from print cost directly adds to your royalty.

4. Factor in fixed surcharges and fees

Don’t forget to include the print service surcharge, market access fee, or other per‑copy fees in your calculations.

5. Build in a “buffer” for returns

Because returns can be volatile, treat part of your projected royalty as margin buffer. In practice, many authors assume a 20–30% return rate when pricing.

6. Run multiple “what if” scenarios

Make a spreadsheet and vary L, D, P, and return rate. See which combinations still give you a positive net royalty.

7. Use direct / share & sell channels where possible

Whenever you can sell directly (via share links or author website), bypass wholesale margins. That improves your take substantially. (As shown in scenario C above)

8. Review your pricing periodically

Print costs, distribution policies, or minimum discount levels may change over time. Revisit your list price and discount every year or two.

Common Pitfalls & Mistakes to Avoid

- Ignoring returns and computing royalty as if all copies are sold with no returns. That gives an overly optimistic number.

- Underpricing, trying to make your book more “affordable” but ending up with negligible margin.

- Setting too low a discount that bookstores refuse to stock your book.

- Neglecting fixed fees or surcharges — they can eat into your numbers significantly.

- Failing to account for market access or currency conversion in non‑U.S. markets.

- Not revisiting settings after changes — if you modify your page count or book specs, re-run your calculation.

- Relying entirely on retail routes when you could use direct sales — taking advantage of share & sell or author direct routes can boost margin.

Real‑World Considerations & Community Insights

- Many authors report “horror stories” where returns vaulted unexpectedly high and significantly cut profits.

- Some authors choose not to allow returns, accepting that their books won’t be stocked in many brick & mortar stores.

- Others split distribution: allow returns for big accounts, but disable returns for smaller orders or special editions.

- In recent years, IngramSpark has increased minimum wholesale discounts (e.g. raising floor to 40 %) in some markets, reducing flexibility.

- Some authors use both KDP and IngramSpark — using KDP for Amazon print royalty advantage, and IngramSpark for bookstore / library access.

One community member on Reddit described:

“If a store orders 10 copies and returns 8, you’re responsible for all fees (including printing and shipping).”

These real stories underscore that distribution choices have financial consequences.

Multiple Markets & Currency Considerations

IngramSpark operates in multiple markets (US, UK, EU, Australia, etc.). For each:

- The print cost (P) is different (local cost, local currency)

- You must enter list price (L) in that market’s currency

- Fees, surcharges, and discounts may vary by market

Thus, you’ll want to run separate compensation calculations per market. Blue Paper’s article shows exactly this: enter the book setup in the UK market, get the UK print charge in £, then translate your royalty formulas.

When optimizing across markets, you may set slightly different list prices in each market to maintain comparable margins.

Long Article Summary / Step‑by‑Step Approach

Here’s a condensed roadmap you can follow when using the royalty calculator for your own book:

- Define your book specs (page count, trim size, color vs black & white, paper type).

- Decide your strategy: do you allow returns? what wholesale discount will you set?

- Get print cost for those specs (IngramSpark’s calculator will show it).

- Choose various list prices and run scenarios.

- Compute gross royalty using the formula:

- R=L×(1–D)–PR = L × (1 – D) – PR=L×(1–D)–P

- Apply return rate assumption to compute net royalty.

- Compare results across scenarios and pick pricing that gives you a healthy margin while being market‑acceptable.

- Explore direct / share & sell mode to bypass wholesale discount where feasible.

- Review periodically — costs, policies, or market conditions may change.

- Consider splitting distribution routes — KDP for Amazon, IngramSpark for bookstores/libraries.

By doing this, you can make informed pricing decisions rather than guessing.

Sample Full Calculation Example

Let me walk you through a full example from scratch.

Book specs:

- 250 pages, black & white interior

- Trim size: 6″ × 9″ paperback

- Paper: standard white

- Region: U.S. market

Scenario parameters:

- List price (L): $18.99

- Wholesale discount (D): 55%

- Print cost + surcharge (P): $5.20 (estimated via IngramSpark calculator)

- Return rate assumption: 25%

Step 1: Retailer pays: 18.99 × 0.45 = $8.5455

Step 2: Gross royalty: 8.5455 – 5.20 = $3.3455

Step 3: Net royalty per copy (accounting for returns):

- Net = (0.75 × 8.5455) – 5.20 = 6.409125 – 5.20 = $1.2091

So you’d expect about $1.21 on average per copy sold, with a 25% return assumption. If return rates rise, your margin slides; if you choose to sell more directly, your margin can improve.

You can repeat the above with L = 20.99, D = 50%, etc., and decide which gives you enough cushion.

FAQs

1. What is the IngramSpark Royalty Calculator?

The IngramSpark Royalty Calculator (also called the Publisher Compensation Calculator) helps authors and publishers estimate how much money they’ll earn per print book sold through IngramSpark. It factors in list price, wholesale discount, print cost, and fees to show net earnings per copy.

2. How does the royalty formula work?

The basic royalty formula is:

Royalty = (List Price × (1 – Wholesale Discount)) – Print Cost – Fees.

It shows your gross earnings before returns. You can adjust for returns using:

Net Royalty = (1 – Return Rate) × (List Price × (1 – Discount)) – Print Cost.

3. What’s the difference between wholesale discount and returns?

The wholesale discount determines how much of your list price booksellers pay you. Returns affect how much money you keep after some books are sent back unsold. Both strongly impact your real-world profit per sale.

4. What’s a good wholesale discount for IngramSpark?

A 55% discount is standard in the book trade, making your title more appealing to bookstores. You can set a lower discount (e.g., 40–45%) to earn more per sale, but some retailers might not accept your book at that rate.

5. How can I increase my royalties on IngramSpark?

Use standard trim sizes, reduce page count, and opt for black & white printing when possible. Also consider direct sales or the Share & Sell model, which bypasses wholesale discounts and gives you a higher per-copy profit.

Final Thoughts & Recommendations

The IngramSpark royalty (publisher compensation) calculator is a powerful tool — but it’s only as good as your assumptions (especially return rate).

- Always factor in returns realistically; never assume zero returns.

- Use direct or share & sell channels where possible to bypass wholesale discounts.

- Maintain flexibility: book retailers’ expectations, discount norms, and market policies can change.

- Consider splitting distribution across platforms to maximize each route’s strengths.

- Above all, run multiple pricing & discount scenarios so you understand which combinations yield sustainable margins.

If you like, I can build a ready‑to-use spreadsheet (Excel or Google Sheets) with built‑in formulas for your book (you give me page count, color, target markets), so you can play “what if” yourself. Would you like me to generate that for you now?

English

English Français

Français Deutsch

Deutsch Español

Español Italiano

Italiano Русский

Русский Português

Português العربية

العربية Türkçe

Türkçe Magyar

Magyar Svenska

Svenska Nederlands

Nederlands Ελληνικά

Ελληνικά Български

Български Polski

Polski Gaeilge

Gaeilge Dansk

Dansk Lietuvių kalba

Lietuvių kalba Suomi

Suomi Hrvatski

Hrvatski Română

Română Latviešu valoda

Latviešu valoda Korean

Korean